Residential actual property in India proves to be a solid and dependable funding choice, outperforming different possible choices. Government projects like PMAY force enlargement, with the sphere attracting vital investments.

In the evolving panorama of funding alternatives, residential actual property in India sticks out as one of the resilient and dependable possible choices for traders. Despite financial fluctuations and marketplace uncertainties, the sphere has demonstrated tough efficiency, providing solid returns and long-term worth appreciation.

Following a impressive efficiency in 2023, the housing marketplace continues to thrive, pushed via a transferring client choice in opposition to homeownership over apartment preparations. As traders search enlargement and steadiness, the Indian actual property marketplace shines vivid, atmosphere new benchmarks and surpassing expectancies.

2024 has been promising, and the total outlook for Indian residential actual property seems more and more promising. Amidst a dynamic funding panorama, the sphere has established itself as a bedrock of steadiness and reliability. Current tendencies and signs recommend that residential actual property in India will proceed to be an asset magnificence, outperforming different funding choices and offering a safe haven for traders.

Residential actual property: A rock-solid funding

Amidst huge inconsistency on this planet’s geopolitics situation, India’s residential actual property sector has demonstrated outstanding steadiness. However, India’s resilient economic system and constant call for have created a favorable outlook for business stakeholders, positioning the rustic at the leading edge of enlargement within the sector.

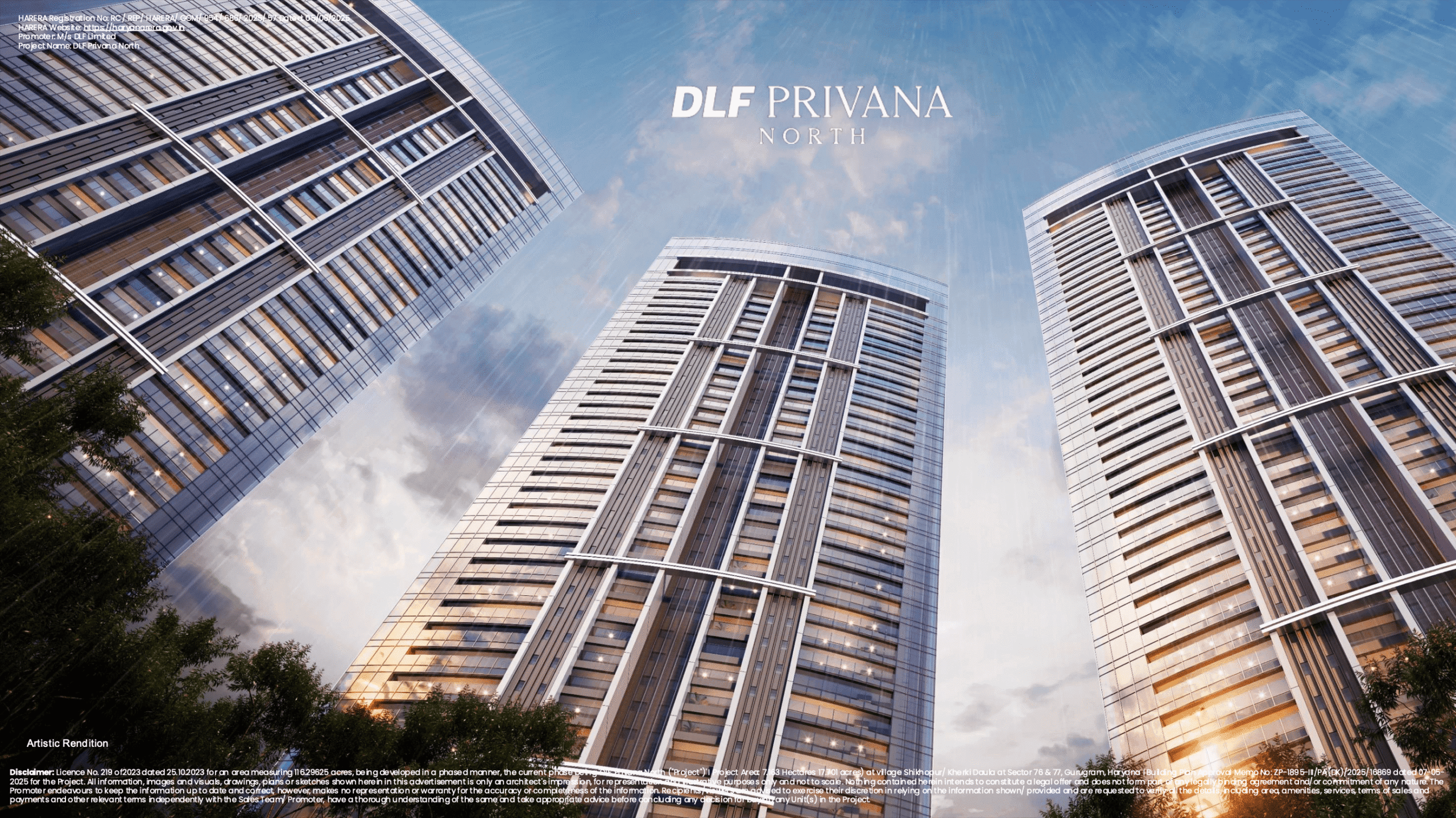

The residential actual property marketplace has been getting better in 2023, considerably contributing to India’s enlargement tale. The business is sturdy, with an anticipated 15-25% build up in new assets launches in 2024. Additionally, gross sales are projected to moreover strengthen via 10-15%, which is crucial for the ongoing development of the actual property marketplace. In 2024, new residential projects in gurgaon in Mumbai are anticipated to extend in worth via 5-8 in step with cent, with a considerable build up within the call for for luxurious and mid-segment houses.

Government projects and coverage strengthen

The Indian executive has presented a number of projects to spice up the actual property sector, in particular housing. Schemes just like the Pradhan Mantri Awas Yojana (PMAY) have given an excellent impetus to each Indian taking a look to construct or purchase his first house. In its first cupboard assembly, the newly shaped executive made up our minds to lend a hand 3 crore further rural and concrete families with space building, addressing the emerging housing wishes of the expanding choice of eligible households. Under the PMAY, a complete of four.21 crore properties were finished for eligible low-income households during the last 10 years.

A promising outlook

The Indian actual property sector attracted investments totalling USD 1.1 billion in Q1 2024, with the residential business main the best way via securing just about USD 693 million. This marks the residential sector because the standout performer amongst quite a lot of asset categories. The sector’s spectacular efficiency is pushed via tough housing call for and a resurgent provide during the last few quarters. Investors are capitalising in this momentum, resulting in the residential section accounting for over 63% of the overall actual property investments in Q1 2024.

Infrastructure enlargement developing new micro markets

In a pivotal transfer in opposition to financial transformation, the Indian executive has intensified its focal point on infrastructure construction, allocating an excellent ₹13.7 lakh crore, an identical to 4.5% of GDP, for capital expenditure. This unwavering dedication underscores the federal government’s determination to development a powerful basis for enlargement and positions India at the trail to changing into a $5 trillion economic system.

A good portion of this funding is directed in opposition to railways, emphasising strategic intermodal connectivity, together with roads, rails, ports, and airports. The number one function is to give a boost to transportation and logistics potency, cut back prices, and bolster India’s international competitiveness.

The synergistic courting between infrastructure funding and actual property construction is well-established. Improvements in roads, public transportation, and facilities grow to be in the past inaccessible spaces into horny possibilities for actual property funding. This infrastructure push now not handiest facilitates rapid financial advantages but in addition units the level for sustainable long-term enlargement, considerably impacting the actual property sector via opening new avenues for construction and funding.

For instance, the lately introduced Atal Setu in Mumbai has created a couple of new markets in and round Navi Mumbai, which is nice information for the MMR’s actual property business.

Conclusion

In absolute phrases, the funding influx into the residential marketplace in Q1 2024 is double the quarterly moderate seen during the last 8 quarters, highlighting a vital surge in investor self assurance and passion within the residential actual property marketplace. This pattern underscores the sphere’s crucial function in using general actual property funding in India. This upswing is supported via a solid economic system, beneficial rates of interest, and a shift in client belief, the place assets possession is more and more considered as a competent monetary protection web.

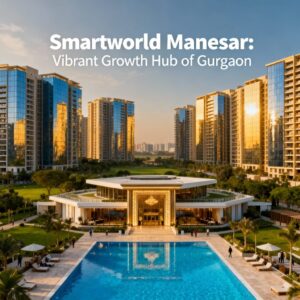

As the marketplace is poised to develop constantly in 2024, new residential projects in gurgaon are witnessing a vital surge in call for. India’s assets markets are displaying tough enlargement, characterized via a considerable build up in new launches and a notable upward thrust in gross sales.

Also read: Why are netizens comparing Gurugram’s property market with that of Dubai?

According to CREDAI, gross sales quantity rose via 35% in 2024, with luxurious section gross sales expanding via 50%. Bolstered via exceptional gross sales momentum and a thriving luxurious section, builders also are taking a look at developing horny actual property funding choices for the traders and the top customers, which is able to force a gentle provide pipeline and solidify main metropolitan towns as key drivers of actual property call for.

The Indian actual property sector, a cornerstone of the economic system and a key motive force of a couple of industries is poised for sustained and strong enlargement. A confluence of things, together with sturdy GDP enlargement, fast urbanisation, emerging earning, and supportive executive projects, is fueling a surge in call for for varied assets sorts.

Also read: Sohna emerging as key residential marketplace, 16k homes planned in next 3 years

Thus, actual property investments are anticipated to develop via 15-20% once a year. This easiest typhoon of certain signs solidifies actual property as a competent and tasty asset magnificence for traders, providing a safe and promising long term.