The Indian real estate marketplace is claimed to get up to 9.3 Billion USD therefore it’s the proper time to make real estate funding in India. There are so much of alternatives and kinds of real estate to take a position into. This weblog has 7 sorts of real estate funding.

Types of Real Estate Investments In India

1. Residential Real Estate Investment in India

Residential real estate is the valuables which an individual buys to are living into or for hire revenue. These homes come with homes, residential plots, flats, builder flooring and condominiums. These can be utilized for private use or may also be publish on hire to get a facet apartment revenue.

One too can put his belongings on platforms like OYO or Airbnb. This is some way too earn a brief time period apartment receive advantages majorly on a in line with night time foundation. Secondly there’s no factor of tenant eviction or upkeep. Leasing out belongings to other folks and get a continuing circulate of revenue. Apart from apartment revenue homes additionally admire through the years making the go back on funding top.

For residential real estate funding in India Delhi NCR, specifically Gurgaon is booming very rapid, except for this Mumbai, Bangalore and Pune also are getting many house patrons being the IT facilities with nice setting and infrastructure.

2. Mutual Funds Real Estate Investment in India

Real Estate funding in India has a top price ticket worth, therefore everybody may no longer be capable to make investments and personal a belongings. Real Estate Mutual Funds lend a hand other people to pool their cash with funding managers who make investments in other homes and you’ll get the appreciation for your percentage.

Here your cash is accumulated with other folks and the fund managers use it to take a position in differing types of homes.the liquidity of those mutual price range is upper in comparison to the possession of a belongings. This manner you’ll promote your stocks in step with your selection and choose out. You too can diversify your portfolio whilst making an investment in real estate mutual price range and scale back the chance of failure.

The dangers related to this funding also are top. These investments are at once dependent in the marketplace and therefore may fail at negative occasions. So one will have to stay their

3. Commercial Real Estate Investment in India

Commercial real estate funding in India is an overly profitable funding because it has a top apartment and appreciation worth. The dangers related to industrial real estate also are decrease in comparison to different real estate because the rent is signed for an extended length and emptiness may be for an overly brief length.

Another receive advantages of industrial real estate is signing the triple internet rent. This sort of rent places the load of all kinds of further bills associated with the valuables at the tenant. The bills come with belongings tax, insurance coverage, and upkeep. Hence it helps to keep the landlord worry-free.

If you wish to have to take a position in industrial homes you will have to do a radical analysis to steer clear of any hurdle. The following issues will have to be stored in thoughts earlier than deciding on the required belongings, call for and provide, emptiness, tax, and apartment revenue in that house.

4. REITs (Real Estate Investment Trusts) Real Estate Investment in India

REITs are a well-liked means of Real Estate Investment in India. The REITs are firms that purchase income-generating real estate and you’ll purchase stocks in those firms and earn dividends and benefit. Here you’ll make a small funding and earn in step with your pocket measurement.

REITs come beneath the supervision of SEBI (Securities and Exchanges Board of India) in India. SEBI is answerable for the right kind functioning and responsibility of REITs. In those price range other people could make small investments and experience the advantages of real estate appreciation.

The Embassy Office parks is one of the most productive examples of REIT in India. Its IPO was once introduced in 2019. The REITs include 3 portions sponsor, the one that units up the REIT. Then comes the Trustee, who manages the REIT and in the remaining is the Manager who oversees the procedures of the REIT.

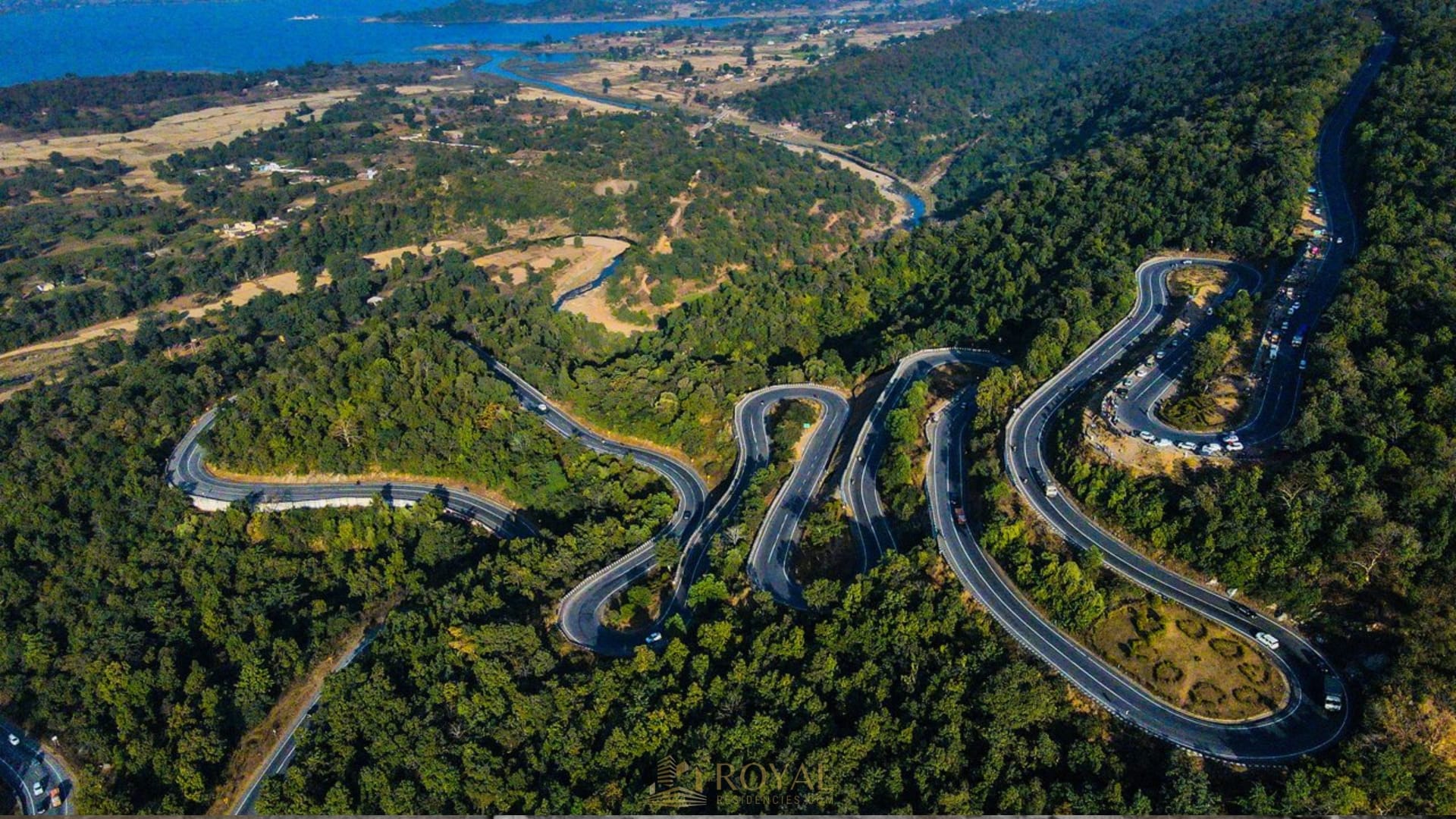

5. InvITs (Infrastructure Investment Trusts) Real Estate Investment in India

InvITs InvITs are an effective way for real estate funding in India. They are very similar to the REIT however as an alternative of making an investment in real estate, they make investments in infrastructure initiatives like roads, highways , airports and so forth.

The Income of InvITs is generated via tolls and taxes imposed at the customers of the amenities of the infrastructure initiatives. For instance the malls on a metro station or department shops made on a bus terminal.

Just like REITs, InvITs let you make investments in massive initiatives with a small quantity of cash. They also are regulated through SEBI, which makes them a protected funding choice.

6. Farmhouses and Agricultural Land

A farmhouse is a residential development positioned on agricultural land. People continuously purchase farmhouses as weekend houses or to experience a relaxed, rural way of life. These homes are generally constructed to deal with cattle or retailer farm produce.

Farmhouses be offering a good chance to diversify your funding portfolio. You don’t want to convert the rural land to construct a farmhouse, however you can’t use it for industrial functions except you get the vital allows.

Agricultural land may also be a precious funding. Although it’s no longer regarded as real estate, you’ll convert it to non-agricultural use and make it a component of your real estate portfolio. If you intend to make use of the land for farming, you’ll develop vegetation, apply natural farming, or rear livestock.

There are a number of benefits to proudly owning agricultural land:

- It creates long-term wealth.

- Income from farm produce is tax-free.

- The land doesn’t depreciate.

- Agricultural land acts as a hedge towards inflation.

However, there are specific issues to bear in mind of. You can’t use agricultural land for industrial functions with out changing it. Also, earlier than purchasing agricultural land, you should definitely take a look at all prison paperwork, akin to name deeds and earnings information, to steer clear of any prison problems.

Also read: Everything You Should Know About Dwarka Expressway Gurgaon

Conclusion: Diversify and Plan Wisely

There are many oppturnity in real estate funding in India

Whether you wish to have a gradual revenue from renting residential properties in gurgaon, have an interest in the versatility of REITs, or need to make investments in industrial areas, real estate generally is a precious addition for your funding portfolio. Remember to diversify your investments to unfold your possibility and maximize your attainable returns.

Also read: All You Need To Know About Sohna Road Gurgaon

With cautious making plans and marketplace analysis, real estate making an investment will let you construct long-term wealth and monetary safety.